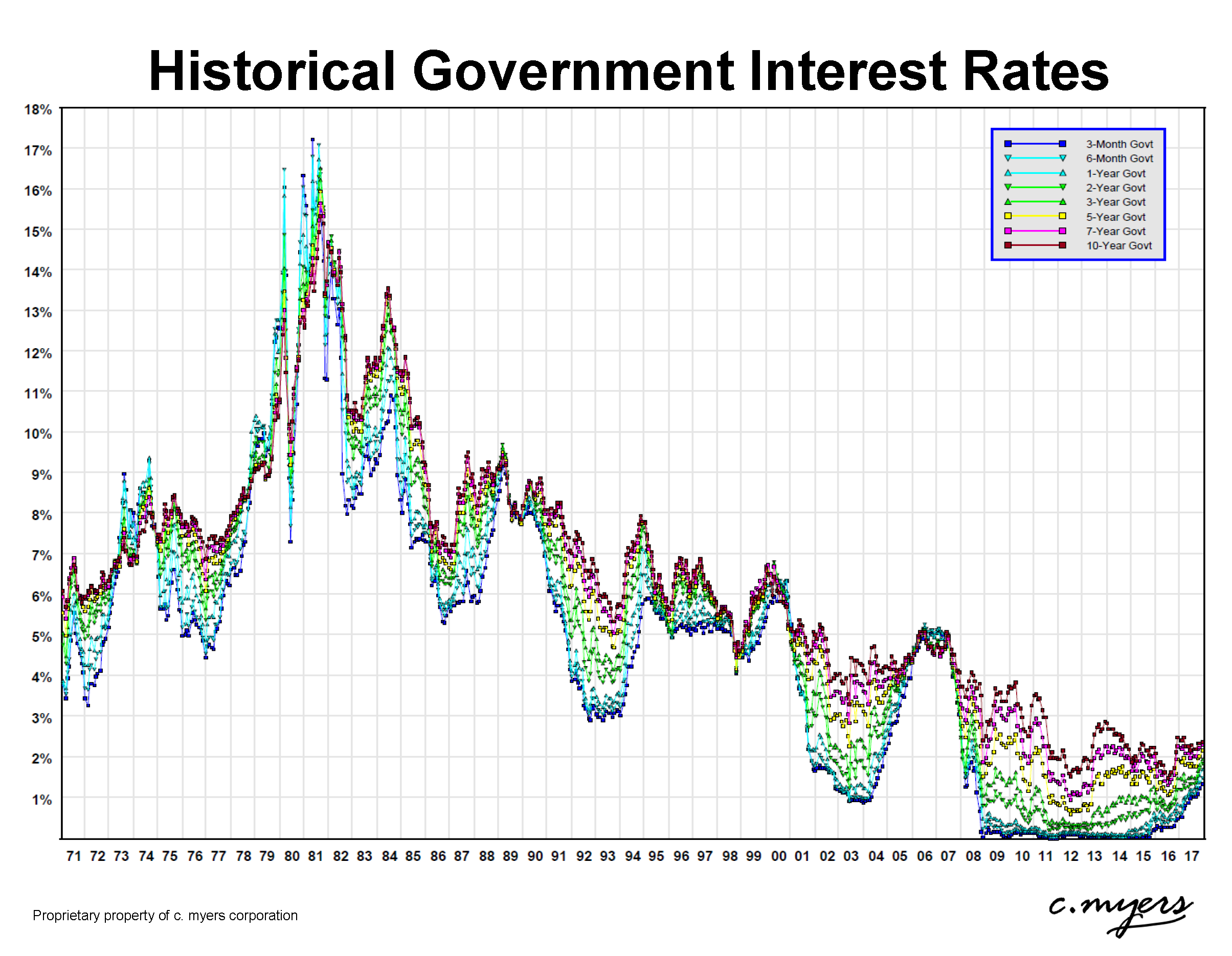

Webjul 29, 2020 · the business interest expense deduction limitation does not apply to certain small businesses whose gross receipts are $26 million or less, electing real property. Webfor taxable years beginning after december 31, 2017, the limitation applies to all taxpayers who have business interest expense, other than certain small businesses that meet the. Websep 1, 2019 · for tax years beginning after 2017, the deduction for business interest expense cannot exceed the sum of the taxpayer's: Floor plan financing interest expense.

Recent Post

- Iv Therapy Rn Jobs Near Me

- Beaver County News Alerts

- Live Traffic Cam Howard Frankland Bridge

- North Node 7th House

- Hollywood Palms Cinema Woodridge Il

- Aquarius Lottery Lucky Numbers

- Mashable Wordle Hints Today

- Desert Center Accident Today

- Susan Aikens Husband

- Daily Arrest Osceola County

- Choppy Bob Short

- Lorain Busted Newspaper

- National Weather Detroit

- Look Up Sw Serial Numbers

- Curly Mullets Short

Trending Keywords

Recent Search

- Askcarsales Reddit

- 247 National Signing Day

- Sams Club Gas Pric

- Heraldmail Hagerstown Md

- Uvm Bookstore

- North Carolina Scratch Off Lottery Tickets

- Med Spa Rn Jobs

- Simply Hired Usa

- Miami Mugshots Zone

- Goodnight Babe Meme

- Boxrec Ali

- Glaxosmithkline Layoffs

- Hot School Teachers

- Zillow St Petersburg Fl Rentals

- Does Cvs Do Tb Tests

![How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve](https://blog.hubspot.com/hs-fs/hubfs/Sample Letter of Interest Example.png?width=2318&name=Sample Letter of Interest Example.png)